Escobar, Michaels & Associates

When Your Life Is On The Line

Tampa Criminal Defense Law Firm

Your Pursuit Of Justice Starts Here

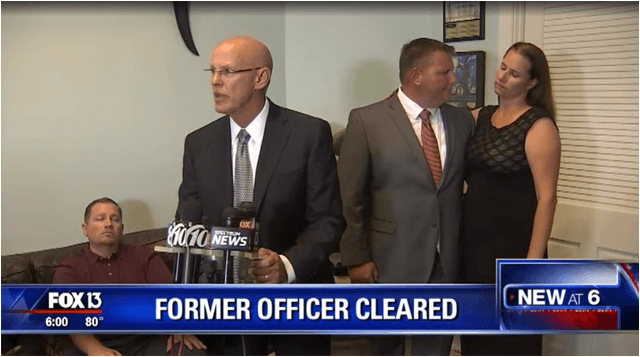

Escobar, Michaels & Associates, based in Tampa and serving clients across Florida, provides superior legal representation to individuals in criminal defense. Since our founding in 1986, our attorneys, paralegals and support staff have taken an aggressive, creative approach to each case. We thrive on winning for our clients and will stop at nothing in our quest for justice.

Achieving success in any criminal case depends largely on the skill and experience of your legal counsel. At Escobar, Michaels & Associates, our only goal is to seek the dismissal of charges or an acquittal at trial. We review every case thoroughly with the help of knowledgeable forensic investigators. No detail is too small, and no case is too complex.

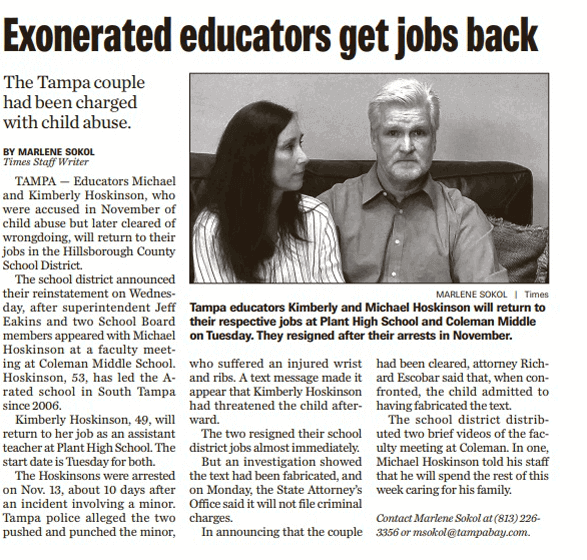

We never take a police officer’s word at face value. All too often, we find that law enforcement agents misrepresent the facts, exaggerate or even lie. By working tirelessly to uncover the truth, we are frequently able to achieve positive results for people facing life-altering criminal accusations. Our law firm defends people facing all types of allegations, including drug charges, white collar crime charges, accusations of violent crimes and drunk driving. Fighting for clients in state and federal courts across Florida, we are prepared to do battle in the defense of your rights.

The Sooner You Act, The More Options You Will Have

In the initial stages of any criminal investigation, the police and prosecutors typically have a slight initial advantage, as they are gathering evidence and building a case for prosecution. For this reason alone, if you believe the police are investigating you, it is critical to contact our attorneys. We will even the odds, taking steps to preserve evidence that is favorable to your case. Frequently, early intervention on our part may lead to charges never being filed. This can create untold peace of mind, while saving you the costs associated with a lengthy defense and possible trial.

If you have been arrested, we will take immediate action aimed at protecting your rights. Our Tampa criminal defense lawyers have more than 90 years of combined trial experience and will always be prepared to go to trial if we believe that is the best way to achieve a just outcome. Our lawyers have tried all types of cases, from relatively minor misdemeanor trials to complex, multidefendant, international criminal cases. Our experience is your advantage.

Our Case Results

Recent Articles

Cocaine offenses in Florida: What to expect when facing charges

Cocaine is a substance that stimulates the reward pathway in a person's brain, creating intense feelings of happiness. However, the illegal drug also has a high risk of causing...

Stealing from elders can lead to more severe penalties

Theft is an offense where the penalties a convicted person faces depend on several factors, mainly the value of the money or items involved in the offense. In Florida, however,...

Is it a crime to use a firearm while drunk?

Law-abiding gun owners are expected to be responsible for the way they use their firearms. Although Florida allows the permitless ownership of firearms, gun owners must still...